Progress made on the implementation of the action during the reporting period

In this chapter we reflect on achievements and challenges encountered from project start till the end of 2024.

Achievements and challenges encountered

Achievements

Since the start of M-MCP we reached many achievements in terms of intervention origination, execution and program management. These are listed below.

Table 3: Achievements from Program start till end 2024

|

Implementation theme |

Achievement |

|

Project selection |

We made good decisions on execution (CASA+ and ARIA). We could have started small, but we went big and bold supporting ambitious projects, working with other DFIs, entering difficult markets. We are building momentum and visibility. This also enabled us to kick-start our work. Whilst these are Ecosystems projects, we are seeing compelling Business Development outcomes as a result. |

|

Project execution |

We were bold and hands-on. We have moved beyond theoretical frameworks to implement initiatives with tangible benefits already being seen by enterprises and other players in the entreprenurial ecosystems we have targeted. Our efforts are characterized by practical implementation - we are actively iterating on and executing market creation strategies, learning through direct engagement with markets and stakeholders. We are making sense of a complex topic. We are playing a unique and pioneering role as a DFI in this space. |

|

Collaboration/ interaction |

We have created a model for a collaborative approach with Triple Jump. The early-stage finance envelope (described in more detail in section 3.2.3) is an example of an effective joined up approach. Here we combined FMO and Triple Jump’s intervention design models together into one approach. |

|

We have effectively collaborated with our investment teams, finding champions and fostering productive engagements. Grounded in existing relationships, our team has been successful in connecting with people to understand and begin to make progress on some of the challenges faced by investors. |

|

|

We are partnering – not just managing contracts – and it is adding value. We are working effectively with service providers and partners to add value. We are not just taking a top-down role and managing with KPIs. Instead, we have been actively collaborating, for example, by joining Technoserve in their in-country scoping missions to connect them with our network of clients and partners on the ground. |

|

|

We are learning how to work effectively with a group of intervention partners with different mandates. In working with partners with different interests and criteria, it is important to be clear how that works, i.e. to have the correct governance, a clear scope of work, mandate, and collaboration model in place. |

|

|

Process |

Using existing products, processes, and principles made it possible to get up and running quickly. We recognize enhancement of our processes is needed in the long run to implement market creation at scale, however using existing ways of workings has helped us to kick start market creation activities. |

|

Fundraising activities leveraging M-MCP have been successful. Partly due to existing relationships and aligned mandates with MoFA and EU, fundraising for market creation has been successful and resulted in contracting €33.7M additional funding from the EC by the end of 2024. |

Challenges

Challenges we encountered in program execution from Program start till end 2024 are listed in table 4 below.

Table 4: Challenges encountered from Program start till end 2024

|

Implementation theme |

Challenge |

|

Project design |

Establishing new ways of working to design for systems change. Technical Assistance (TA) within DFI’s is typically based on client demand and defining the mandate with limited stakeholder consultation to design the scope and solution is relatively straightforward. Market creation on the other hand involves complexity with systems and an increased ask of stakeholder management and coordination, internal and external. This requires a change of ways of working for FMO and the teams implementing Market Creation, typified as a shift from a solutions-orientated approach to a highly collaborative, system- thinking one. This change management is still ongoing. |

|

Communication |

Communication of our market creation ambitions and goals. With a focus on developing new projects, a new partnership and new ways of working, we have found it challenging to also maintain clear, regular, and consistent communication on our market creation goals, priorities, and activities -with our investment teams and with others in-market. Further improvement is needed here to further support understanding of market creation, set realistic expectations, and encourage effective collaborations. |

|

Collaboration |

Establishing a clear process to work with Triple Jump. Not having established ways of working led to some inefficiencies in the beginning of the partnership. Putting in place an effective governance framework around the partnership has helped to improve this collaboration and to seek potential synergies and benefits. In this communication and alignment is key, and we have adapted in order to make the collaboration fruitful. |

|

Processes |

The Market Creation Program required enhancement of our processes to facilitate efficient delivery at scale. Moving the program into our business as Usual (BAU) operations required enhancement in, amongst others, our internal program governance structures, financial management set-up and approval templates, which required significant efforts given FMO is operating as a regulated bank. |

|

Impact measurement |

Measuring market creation impacts is complex. This requires a balance between the need for meaningful short-term intervention-level impact measurement with tracking progress towards long- term systemic impact across multiple interventions. With new projects being added to our portfolio, we are continuously refining the indicators we use on an intervention level to measure progress. We maintain a “learning heavy, indicator light” stance. |

|

Program scaling |

Scaling the program poses challenges. The program cannot be scaled in the same way a fund can. Each funder will come with restrictions in mandate and funding. As a result, the long-term growth and sustainability of this program remain dependent on securing additional funding and aligning this with the Theory of Change of the M-MCP. With the currently changing funding landscape this is increasingly difficult. |

Origination and project implementation overview

Introduction

To design interventions that are closely aligned to a) FMO’s Market Creation operational strategy for financial inclusion, and b) DGGF’s Seed interventions, FMO has introduced a process where a portfolio of potential projects around a specific theme (so called envelopes) are designed and approved before we invest time in originating individual interventions. Since the start of the program, three envelopes have been approved, namely an agri SME finance, a frontier markets and early-stage finance envelope. The below paragraphs introduce each envelope, describe the projects originated and contracted under each of them, and highlight outputs achieved.

Agri SME finance envelope

In December 2023, the Agri SME Finance Envelope was approved. This envelope intends to lower the barriers to invest in agri SMEs. These barriers occur on different levels, i.e. on the farmer and agri SME level (lack of technical skills, no access to financial support, limited knowledge and capacity to manage risk), financial intermediate level (no business collateral, perceived high risk sector, limited scalability of clients), and DFI/IFI level (regulatory constraints, FX risks, limited ticket size and lack of local presence). In order to lower these barriers, a number or projects were envisioned under the Agri SME Financing envelope. In 2024, Commercial Agriculture for smallholders and agribusiness Market Building Program (Casa+) was contracted as the first project under this envelope.

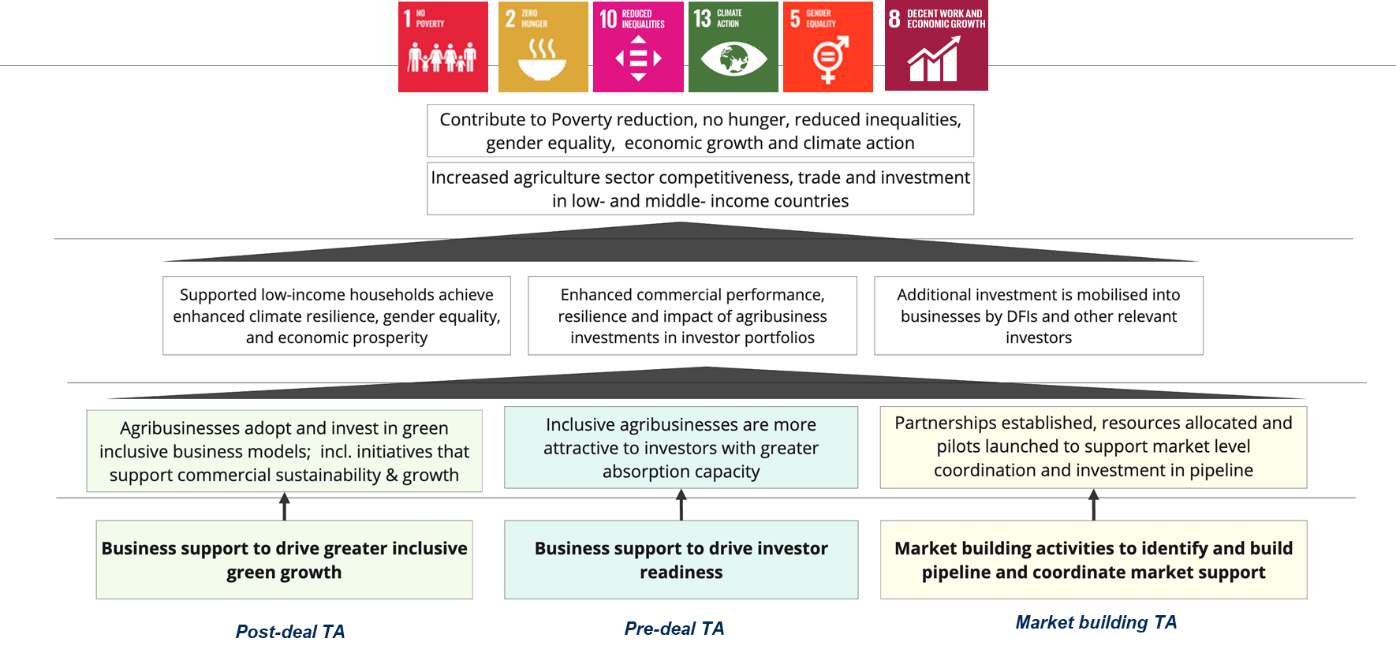

The objective of the CASA plus Program is to increase agriculture sector competitiveness, trade and investment in low- and middle-income countries and more specifically for Market Creation, to mobilize additional investment in business by both DFIs and other investors (see figure 1 Theory of Change (ToC) of the Casa Plus program). The M-MCP contribution of USD 1mln goes towards the $1.5M market creation component of the project, which is implemented by TechnoServe and has a 2-year pilot approach, running until March 2026.

Figure 1: The ToC shows the Casa plus program is resulting in increased agricultural sector competitiveness, trade and investment in low-and middle-income countries, thereby contributing to various SDGs.

The Market creation component focuses on two countries, Nigeria and Tanzania. After a consultation round, these countries were selected as high potential markets for agri-investments for FMO, BII and other investors. After country selection, Technoserve conducted a deep dive analysis of the local agribusiness sectors in these countries, specially focused on small holder value chains. From this analysis, a long list of interventions was compiled and ultimately, three interventions were selected.

Table 5: in 2024, CASA+ selected 3 interventions to drive ecosystem support and long-term pipeline development in the agricultural sector

|

Intervention |

Summary |

Progress update (YE 2024) |

|

Intervention 1: Early-stage impact investors/ fund managers support (Tanzania & Kenya1) |

Support a set of early-stage impact investors (e.g., ARAF, Acumen, Sahel Capital, CFC, etc.) throughout the investment lifecycle, from pipelining, to screening, pre-investment TA (including DD), post investment TA. This includes a couple of cross cutting topics/issues that early-stage investors face more broadly (e.g., solutions to FX, having the right TA facilities, etc.). |

|

|

Intervention 2: Support to Financial institutions in Tanzania to growth Agri-lending portfolio’s (Tanzania) |

Focus direct support on one FI (most likely NMB) to help them grow their agribusiness portfolio, thereby creating access to finance for agri SMEs. The intervention is twofold, providing direct capacity building to the loan officers in the bank, as well as providing direct capacity building to the agribusinesses (subset) that will be able to obtain a credit line. Aceli Africa and a local consultant will be implementing partners of this intervention. |

Contract with preferred bank not finalized yet |

|

Intervention 3: Provide pre-investment TA to Tech enabled aggregators (Nigeria) |

Support two Tier 2 tech-enabled aggregators to grow their business to enter DFI pipeline down the line (3-5y), including engaging local investors (i.e., Sahel Capital, ARAF, Acumen) and connecting them to the businesses. |

|

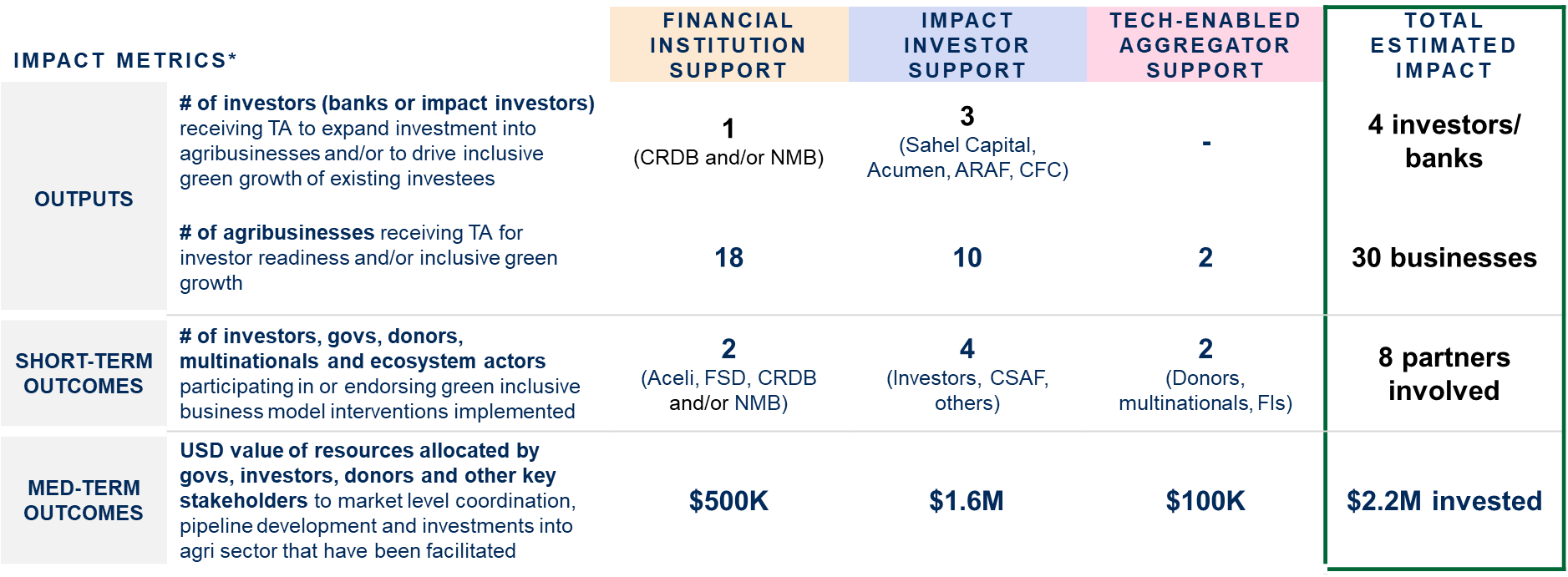

Casa Plus has set Impact metrics across the interventions, aiming to reach a number of players across the spectrum. An overarching learning agenda has been set for the pilot phase, focusing on the question how DFIs and donors can work better together to create financial inclusion for Agri SMEs. A series of workshops, expert panels and a learning paper are envisioned for 2025 and quarter 1 of 2026.

Figure 2: The Casa Plus market creation pilot targets in impacting local banks, businesses and ecosystem partners.

Frontier markets envelope

The Frontier markets envelope links directly to FMO’s 2030 strategy under the Reducing Inequalities SDG which seeks to invest and develop a proof of concept for successfully investing in fragile & conflict-affected areas (frontier markets). The envelope focuses on addressing barriers to investments and unlocking investments in Ethiopia, Democratic Republic of Congo (DRC) and Nigeria.

The African Resilience Accelerator (ARIA) has been approved as a project under the Frontier markets envelope with a total contribution of €1.5M under M-MCP. Launched in 2021, ARIA was initially implemented as a collaboration between BII and FMO, with Proparco subsequently being onboarded at the start of 2025 as a joint funding partner to support programme scale-up to 2027.

ARIA drives development impact in the most underserved frontier markets in Africa by unlocking investments in sectors including Financial Inclusion, Agriculture, and Energy among others. ARIA achieves this by providing both targeted technical assistance to companies (in other words there is a strong business development component) as well as broader ecosystem building to the enabling investment environment. Through this work, DFI transactions that might otherwise not happen are identified and advanced. ARIA’s Country Managers provide an on-the-ground presence in the programme’s focus countries of Sierra Leone, Liberia, Benin, Ethiopia and DRC, with near term future expansion to Togo and Guinea planned in 2025.

Next to BII, FMO and Proparco, ARIA supports an additional 15 other DFIs such as IFC, Swedfund, and U.S. International Development Corporation (DFC) by developing a pipeline of poitential investments and facilitating the link to investors, sharing investment best practices, coordinating investment-focused country trips tailored to their needs and even collaborating in the delivery of technical assistance and supporting the drafting of investment memos for instance providing contextual information to help investment decisions. Beyond DFIs, ARIA also engages a broader set of relevant impact investors - for instance collaborating closely with Triple Jump in Ethiopia through due diligence and capacity building support advance their pipeline investees (e.g., Africa Renaissance Fund – ARF). Alongside investor collaboration, ARIA engages with other stakeholders advancing private sector development (FCDO, USAID and others), which helps us to bring the worlds of Development Finance and Donor-driven Private Sector Development closer together.

As at the end of 2024, ARIA has referred 148 deals to DFIs, with 54 of those opportunities being explored further by investment teams, encompassing SMEs, Capital Allocators / Financial Institutions and other projects. So far, six deals marking a value of $67 million have successfully received IC approval with the programme supporting >50 companies with TA support. Core activities undertaken by ARIA during 2024 are listed in the table 6 below. As each of the listed activities already commenced before our ARIA funding was approved, full results do not appear in our program results framework.

Table 6: Key activities of the ARIA program in 2024, to which the M-MCP provided a contribution to.

|

Intervention focus |

Summary |

|

Provision of origination and pre-investment Technical Assistance |

|

|

Deployment of Ecosystem activities |

|

|

Forming partnerships with relevant other donor programming in country |

|

|

Nurturing partnerships with local governments, regulators and other stakeholders. |

|

ARIA is currently being implemented with the support of service providers Crossboundary and Cadmus. With the current contract finishing in March 2025 the procurement of a service provider(s) for the next phase of the project (2025-27) is currently in advanced stages.

Early-stage finance envelope

This envelope has been recently approved and has been co-designed by FMO and Triple Jump. The envelope focuses on addressing barriers and unlocking opportunities related to early-stage finance in sub-Saharan Africa, with an additional focus on unlocking local currency funding through leveraging pension funds and other local institutional investors. In addition, to facilitate learning and replication in other markets, this envelope also intends to contribute to the rolling out of thought leadership pieces with real examples about how local institutional investors like pension funds can be leveraged to increase access to affordable finance, suitable for early-stage companies.

Within the reporting period one project was contracted under this envelope, namely with project partner Vilcap (€1M) to manage the Market Development: Africa Catalytic Investment Facility. This facility partners with local ESOs in Nigeria, Ghana and Tanzania to drive capital to entrepreneurs developing solutions that enhance economic and climate resilience, with the overarching goal of strengthening the regional entrepreneurship ecosystem. The project is carried out in partnership with RVO and further leverage their work under the Orange Corners Programme and Orange Corners Innovation Fund (OCIF) to support youth entrepreneurs in the target countries. This illustrates how under the M-MCP further synergies between Dutch initiatives and organisations are sought. As the project was contracted in December 2024, no project results are included in this report.

Triple Jump partnership development

The partnership between Triple Jump and FMO is governed by the joined proposal we submitted, formulating a set of joined deliverables under MMCP. Table 7 below displays the deliverables agreed upon covered during the reporting period.

Table 7: deliverables partnership FMO-Triple Jump from our joined proposal

|

Q3-4 2023 |

Q1-Q4 2024 |

|

|

In January 2024 an MoU and NDA was signed to govern the collaboration between Triple Jump and FMO in the MMCP pilot. To support this collaboration, a governance structure was set up, consisting of a steering group and a pipeline working group. The steerco meets on bi-monthly basis and is a forum where operational progress and governance topics for collaboration are discussed. Next to this, bi-monthly pipeline meetings between FMO and Triple jump have been initiated to identify further opportunities for synergy on the ground through our operational teams. Both FMO and Triple Jump also provide feedback on each other’s pipeline through participating in each organization’s opportunity scans and Investment committees. Through joint quarterly meetings with DDE, we report on progress towards deepening a synergistic partnership.

Next to developing a governance structure, also various tools were developed to further support collaboration. FMO and Triple Jump co-created the early-stage finance envelope which further supports alignment in project origination between the two parties. Furthermore, in December 2024, the first version of the joint fundraising proposal was completed. This proposal is a “living document” which informs fundraising opportunities to further scale the SCBD facility as part of FMO’s overall Market Creation fundraising efforts. These tools have helped in further enhancing our strategic alignment and improving process efficiency between FMO and Triple Jump (see outcomes of the partnership evaluation on paragraph 4.2.1), and we will continue these efforts in 2025.

Market Creation platform development and embedding

The Market Creation (MC) Platform development process is an iterative process of which the design requirements have evolved during 2024, in line with learnings from operationalizing market creation within FMO as well as the Market creation interventions we are currently implementing. Key lessons learnt include:

-

New and optimized capabilities (in terms of processes, tooling, knowledge) are required to meet different and varying donor requirements

-

Remaining close to FMO investment teams and the FMO brand is critical to the success of market creation activities

-

DFIs support the initiative to remove ‘barriers’ to DFI investment but often are limited in time/resource to solve these challenges

-

DFIs find managing donor funding complex and organize market creation-like activities differently

-

The term ‘platform’ can be interpreted differently by different stakeholders, creating some confusion and emphasizing the need to better brand market creation activities

-

Optimizing market creation activities within FMO is an ongoing process, and the time required to achieve this change has been longer than expected. New requirements are often identified via rolling out market creation programs and via operating within a multi-funder environment

-

There is limited ‘core-funding’ available in the market and as such as a clearer business model is required to ensure the long-term sustainability of scaling a market creation organization (i.e. platform)

To ensure that the lessons learnt are incorporated in the development of the platform and sufficiently embedded within FMO, the internal FMO market creation project is structured in a way both are supported by either the Platform workstream or the Governance, Processes and Systems workstream.

Where the Platform workstream focusses on refining the long-term platform vision and business planning, creating a clear and understood value proposition, determining a business model for long-term sustainability and the required business capabilities (such as a multi-donor cost accounting capability); the Process, Governance and Systems workstream focusses on operationalizing this value proposition and the related capabilities within FMO by establishing and improving the FMO processes, governance and systems. Specific areas of improvement include cross-departmental alignment, efficiency and accountability, uniform and consistent documentation and reporting, and data accessibility and integration.

Overall, the reception of the Platform has been positive by various stakeholders engaged so far; they see a clear need for bridging the gap between donor private sector development programming and investment mandates of DFIs towards closing the SGD gaps. However, the value proposition of the platform needs more refinement through deeper engagement with DFIs and relevant stakeholders before launching a minimum viable product (MVP).

Main platform deliverables for 2025:

-

Rolling launch of platform governance forums (donor council and DFI advisory board)

-

Clear platform positioning and determine concrete unique selling points across target groups

-

Determine viable platform business model

-

Launch of platform MVP and platform branding